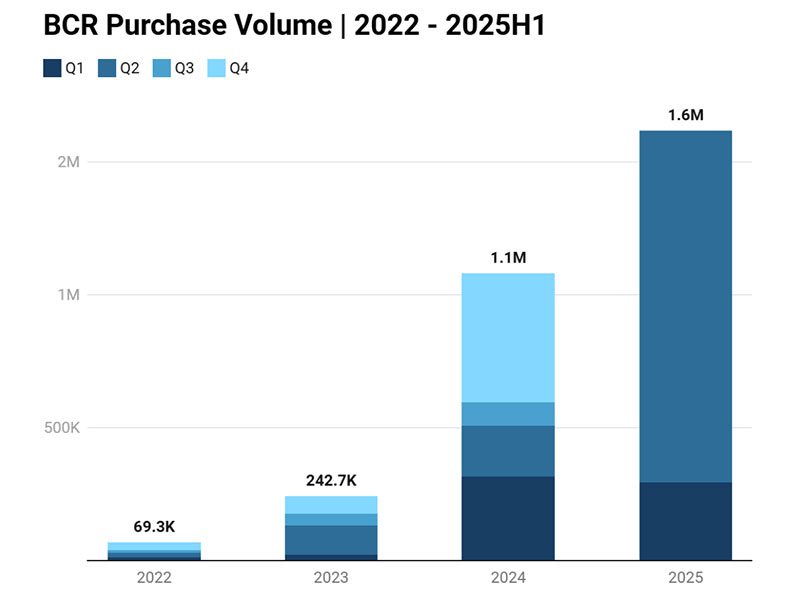

From 2022 to the first half of 2025, the cumulative contracted volume of biochar carbon removal (BCR) credits reached 3.04 million tons. Among them, sales in the first half of 2025 alone reached 1.6 million tons. The average annual purchase volume per buyer increased from 542 tons in 2022 to 762 tons in the first half of 2025.

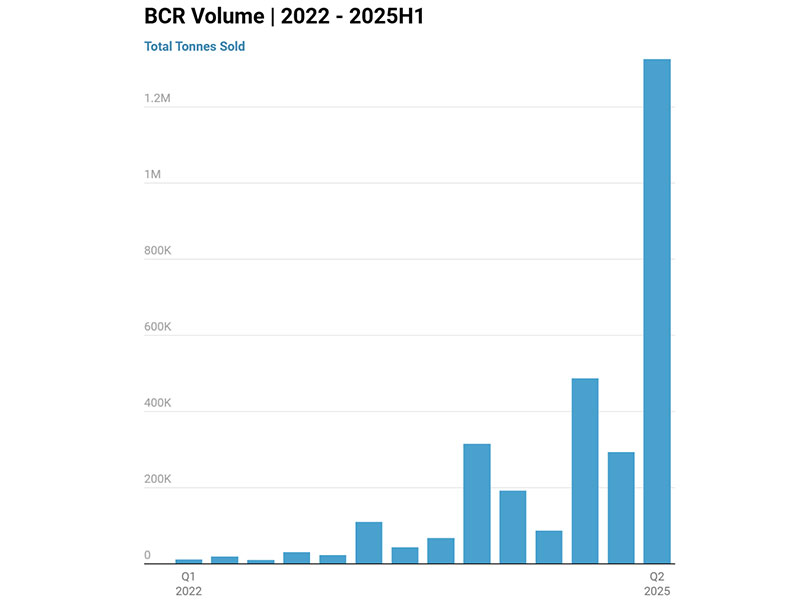

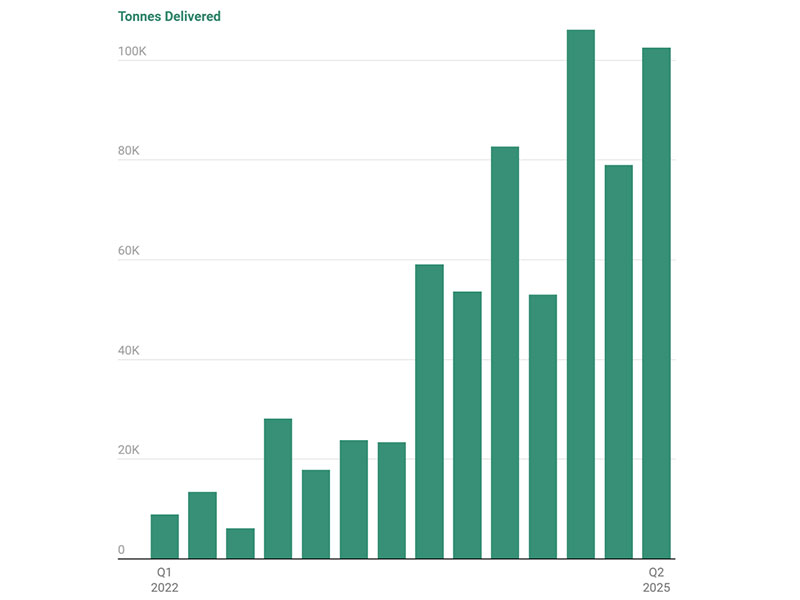

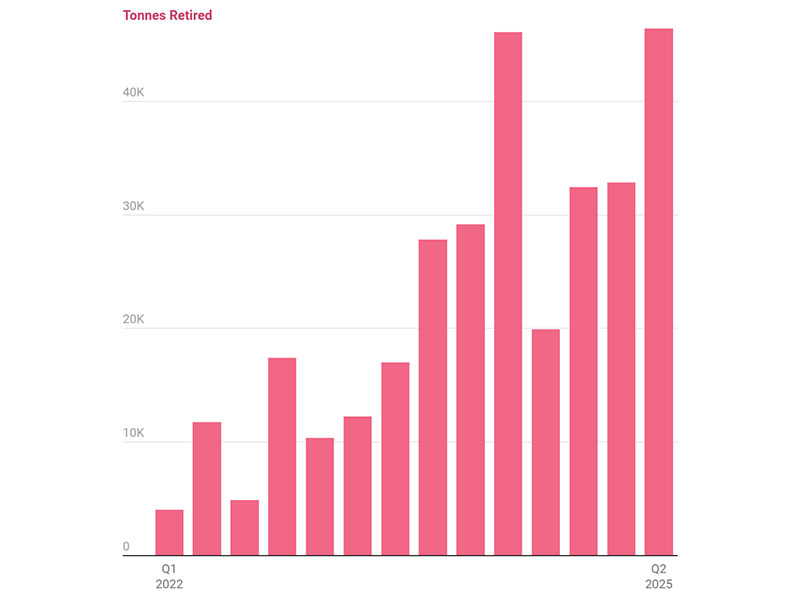

BCR purchases, deliveries, and cancellations all grew rapidly from the beginning of Q1 2022 to the end of Q4 2024. Total contracted volume tripled, while deliveries and cancellations roughly doubled annually.

Overall, since 2022, over 3 million tonnes of biochar carbon removal credits have purchased, with 683,000 tonnes delivered and 330,000 tonnes cancelled.

The rapid growth of these three key metrics—purchases, deliveries, and cancellations—highlights the strong momentum of the biochar carbon removal BCR market.

BCR transaction volume in 2025 further confirms this strong growth trend, with 1.6 million tons signed in the first half of the year alone. However, cancellations in the first and second quarters of 2025 appear to be flat compared to the same period in 2024.

Biochar is the mainstay of the overall market for persistent carbon removal credits. Since the first quarter of 2022, 86% of all credits delivered and 92% of all credits cancelled have come from biochar carbon removal.

Biochar's long-term carbon sequestration capacity makes it a crucial component of carbon removal technologies. In carbon markets, the carbon sequestration capacity of each tonne of biochar can be converted into carbon credits, which can be traded through voluntary or mandatory carbon markets.

As the Paris Agreement pushes countries towards net-zero emissions targets, carbon removal technologies have become a focus of policy and investment. Biochar, due to its relatively low production costs and mature technology, has emerged as an alternative to carbon capture and storage (CCS).

Compared to other carbon removal technologies, biochar's unique advantage lies in its multiple benefits. It not only sequesters carbon but also improves soil quality, reduces fertilizer use, and enhances agricultural productivity.

Mingjie Group provides continuous biomass pyrolysis equipment for biochar production. Producers are responsible for converting biomass into biochar, which agricultural companies then use for soil improvement or pollution remediation. Carbon credit trading platforms, through certification and accounting, transform the carbon sequestration of biochar into tradable assets.

The total amount of biochar carbon removal contracted through forward or spot contracts reached 3.04 million tons. Looking at only the past three years, the BCR market has achieved several-fold year-on-year growth. The total annual tonnage of BCR purchases doubled every year. The total purchase volume in 2024 exceeded the sum of all previous years.

In recent years, the tonnage of biochar delivered has grown rapidly. From 2022 to the end of 2024, BCR's annual delivery tonnage more than doubled every year. Of the total contracted tonnage of 3.04 million tons since 2022, 683,000 tons had been delivered as of the end of the second quarter of 2025.

The tonnage cancelled on credit lines also grew rapidly. Of the 683,000 tons delivered, 330,000 tons were cancelled as of the end of the second quarter of 2025. The sales-to-delivery ratio was approximately 1:2. BCR's total annual cancellations increased by 77% from 2022 to 2023 and by 89% from 2023 to 2024.

An Australian general waste and tire recycling authoritative body turned to Environment Minister Sussan Ley in November last year with a request to prohibit whole bale tire…

Aliapur – a French end-of-life tire management authority – recently announced a call for applications to participate in a tender to renew end-of-life tire collection and recycling contacts for 2021–2024..